KFC Menu Prices, History & Review

5 years ago

What’s Hot on the Bubble Tea Scene in 2024

2 weeks ago

8 Things to Eat in the Fall to Stay Healthy

5 months ago

The Essential Mississippi pot roast recipe

5 months ago

An Easy Baked Rigatoni Recipe

6 months ago

A Step-by-Step Guide: How to Cook Lobster

6 months ago

A Closer Look at Mighty Sesame Tahini

6 months ago

How To Choose the Best Cooking Appliances

8 months ago

The Incredible Produce of Calabria

8 months ago

Seven tips for the perfect home-made pizza party

10 months ago

An Introduction to Coffee Types: The Key Differences

10 months ago

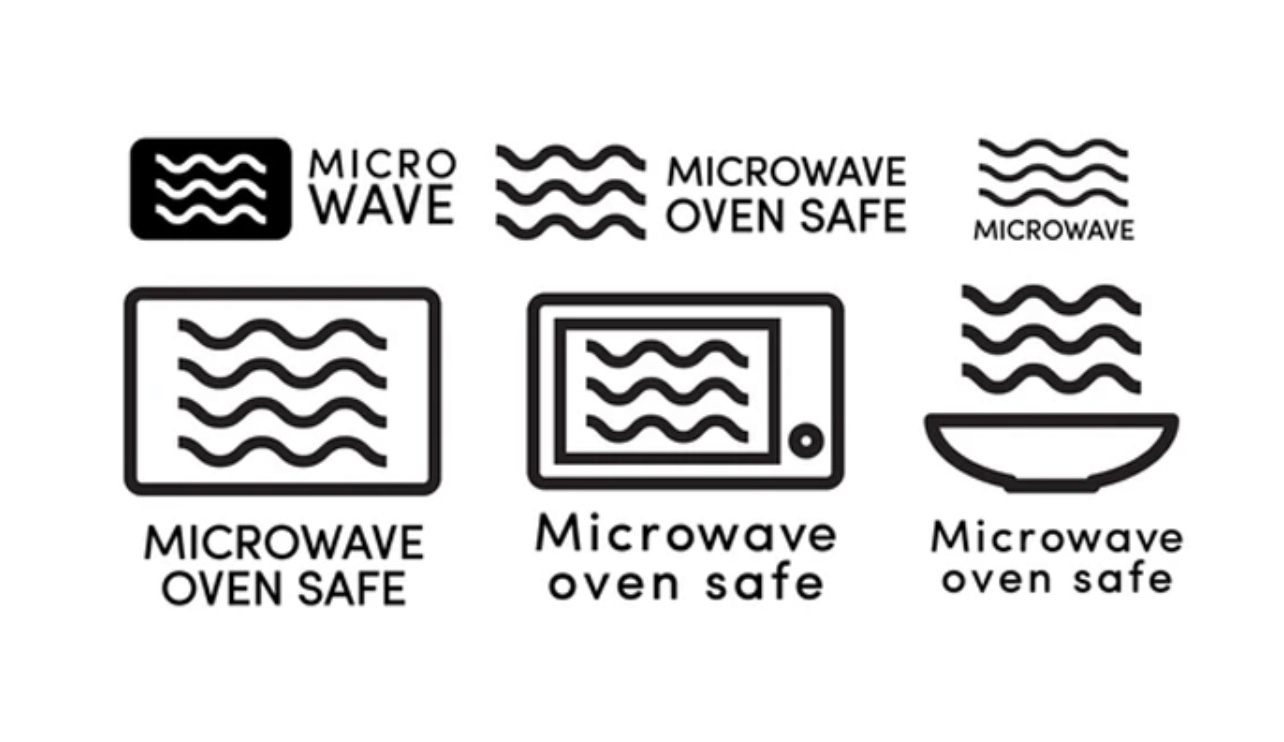

What Does the Microwave-Safe Symbol Mean?

11 months ago

Edible Succulents: A New Spin on These 5 Dishes

11 months ago